John Lewis is the best known and most quoted example of employee ownership but the number of smaller, employee owned businesses in the UK, across a wide range of sectors, is steadily growing with over 1500 business having made the change since 2014.

What is an Employee Ownership Trust (“EOT”)?

First created by the Finance Act 2014, an "EOT is a trust that enables a company to become owned and controlled by its employees. It is established by a company’s existing owners, perhaps as part of their exit or succession planning strategy and helps ensure that the business continues to thrive, providing employment for existing employees and future new employees

An Employee Ownership Trust sale has a significant number of advantages over other forms of exit…

An EOT brings a broad range of benefits to businesses owners looking to sell:

No other type of exit does more to maintain the culture and reputation of your business.

Employee Ownership is shown to drive productivity within companies - when staff feel co-ownership of the business it encourages better business performance and greater loyalty.

Below are a few more of the questions we are regularly asked about EOTs…

-

An EOT is a form of indirect employee share ownership where a controlling interest in the business is held by the EOT for the benefit of all employees. EOTs were introduced in 2014 by the coalition government to promote wider share ownership and more diverse ways of running a business that could create long term sustainable growth. The incentive for owners to sell to EOTs are the very generous tax breaks offered. An EOT is run by trustees a majority of which must be independent of the owner(s). Trustees typically include the company’s directors, employees and external professionals.

-

The business needs to be a trading company (as opposed to an investment company) and have a minimum level of employees who are not the owners or connected persons (e.g. spouses). The owners must also be able to sell a controlling stake (more than 50% of the company’s shares) to the EOT. The EOT route is particularly attractive for professional service businesses and for small and medium sized companies generally (those with a value of £0.5m to £30m). It is also attractive to large companies that fail to generate trade buyer interest. Because the EOT model is self-financing (no external finance is required) the business needs to have a certain level of financial resilience to make it suitable for an EOT transaction. The business should have no external debt (or only minor external debt) and its trading outlook should be profitable and cash generative. Having surplus cash in the business is a positive benefit as it can be used to part fund the overall consideration payable to the owners.

-

Deal costs for an EOT transaction are significantly lower than with a traditional trade sale or management buyout. As with all share sales, stamp duty is paid at 0.5% of the sales price and is borne by the acquiror (the EOT in an EOT transaction). In addition, the cost of testing the feasibility of an EOT transaction is likely to be much lower than the equivalent cost with other exit routes.

-

Deal risks on an EOT transaction are much lower than on other exit routes because there is a clear buyer (the EOT), the price is set by an independent valuation, there is no requirement for external financing and because negotiations are “in-house” involving just the owners, the company and the EOT. The key deal risks for an EOT transaction are the owners changing their mind over whether to sell and unforeseen changes in the trading outlook for the business.

-

The owners get a full market price for the shares that are sold to the EOT. The purchase consideration typically comprises a cash payment at completion (paid out of surplus cash in the business) together with loan notes which the EOT repays over an earnout period (typically 5 years in length) using cash generated by the business. Additional loan notes repayable after the earnout period may also form part of the overall consideration.

-

Selling to an EOT is effectively an “in-house” transaction controlled by the owners and negotiated with the company and the EOT, which the company establishes. The business is independently valued to ensure the trustees of the EOT can be satisfied they are paying a fair market value. This valuation sets the sale price to be paid to the owners which the EOT settles in cash (using any surplus cash in the business) and by issuing loan notes to the owners. The loan notes are scheduled for repayment by the EOT over the earnout period, subject to the EOT receiving funding from the company. During the earnout period or until the loan notes are fully repaid the rights of the EOT are restricted and the owners will continue to retain an element of control of the business.

-

Selling to an EOT has a number of major advantages for the business and staff. Key advantages include the culture of the business being maintained, long term succession planning being possible and management and staff being clearly incentivized (including tax free bonuses of currently up to £3,600 per person per year). All this should help the business retain and recruit good staff, improve employee engagement which together can improve productivity and generate business out-performance.

-

Selling to an EOT can be a relatively quick process typically taking less than 6 months to complete once a decision has been taken by the owners to proceed. This is because the key steps in an EOT transaction are relatively straightforward and the negotiations are very much “in-house” involving the owners, the company and the EOT. With an EOT transaction there are no long delays in identifying buyers, preparing information memoranda, waiting for debt and equity finance to be arranged and negotiating with potential buyers over price, disclosures and onerous warranties.

-

The incentive for owners to sell to EOTs include very generous tax breaks. Provided the owners sell a controlling stake (more than 50% of the company’s shares) to the EOT they can do so without incurring any capital gains tax liability. In addition, the company controlled by the EOT can pay tax-free cash bonuses to employees of up to £3,600 per employee per year.

-

The company’s directors continue to run the business following a sale to the EOT. The EOT has a supervisory role with the right to remove directors acting counter to the EOT’s interests. In principle the EOT can also sell the business. During the earnout period or until the loan notes are fully repaid the rights of the EOT are restricted and the owners will continue to retain an element of control of the business.

-

Yes, the owners can continue to work in the business, and this does not affect their ability to sell their shares free of capital gains tax.

-

Selling to an EOT has several major advantages for the owners. The biggest advantage for the owners can simply be the ability to sell the business at a full market price which otherwise would not be possible via any other exit route or would otherwise be unattractive (for instance due to the impact the sale would have on staff or the culture of the business) or too high risk (for instance due to how an earnout might operate or the risk of sharing sensitive information with a competitor). Other key advantages include control of the sale process and earnout, low deal risks, low costs, flexibility in structuring the transaction and not having to raise external finance.

Generation EO: The Great Succession Opporunity

Recent (Nov ‘23) research undertaken by Ownership at Work, and sponsored by RVE, illustrates the challenge and opportunity that succession within the UK’s large SME business community presents.

Expanding awareness of Employee Ownership is key to ensuring that business owners make an informed decision regarding the future of their company.

“This reinforces our long-held belief that when businesses owners are looking at exit options, they should strongly consider the sale of the business to an Employee Ownership Trust. As the reports’ respondents describe, not only do you achieve a fair market price for the business you secure an independent future for the business and its employees.” - Gerry Young

Jonathan Bray EOT Webinar

In October Gerry and Tom spoke at a webinar organised by Jonathon Bray Consulting. The talk is aimed at law firms considering making the switch to EOT but many of the issues raised are common to all types of company.

We are joined (18 mins) in the presentation by Chris Fallow from Tapestry Compliance, who transitioned into an EOT last year. Chris speaks about the very positive effect that the change has had on the company.

Many thanks to both Chris and the team at Jonathon Bray:

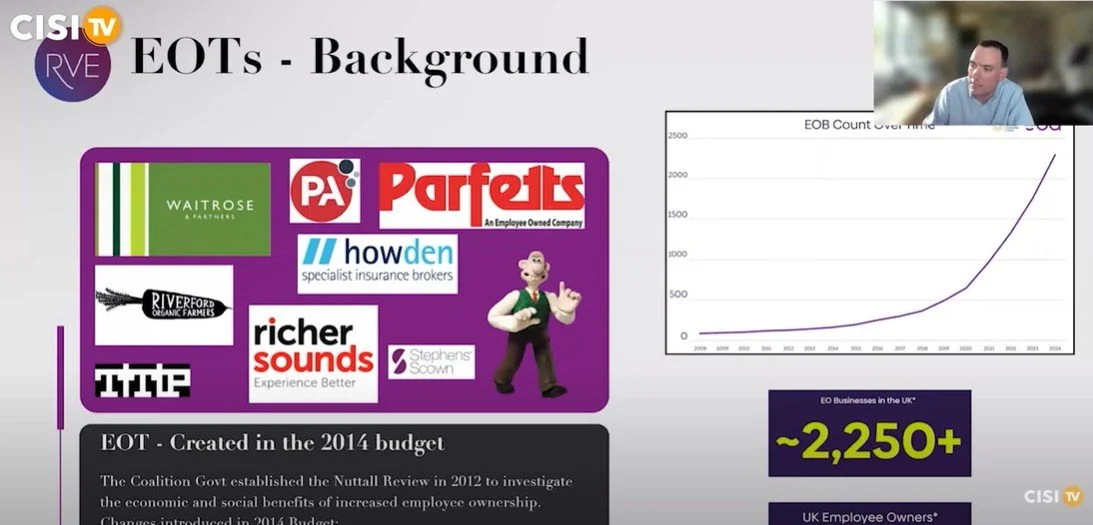

EOT for IFAs, Financial Planners and Wealth Managers

In August 2025 Gerry Young and Tom Lethaby presented a webinar for member of the Chartered Institute for Securities and Investments (CISI) aimed at the owners of businesses that provide financial advice to their clients and require oversight from the FCA for regulated activities.